michigan unemployment income tax refund

If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment.

Solved Turbo Tax Tells Me I Need To Enter A State Identification Number Form 1099 G Box 10b But My 1099 G Form Is Grayed Out And Does Not Provide Me With One What

Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back.

. Texas Income Tax Calculator 2021. Account Services or Guest Services. The refunds are only for people with a gross income under 150000 and only counts toward the first 10200 of unemployment earnings in 2020.

If you make 64900 a year living in the region of Texas USA you will be taxed 7265. As recently as Oct. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Your average tax rate is 1119 and your marginal tax rate is 22. As a result of changes introduced by the American Rescue Plan Americans who have received unemployment compensation no longer have to pay income taxes on the first. Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February.

But theyve since appeared on her campaign website without fanfare. You may check the status of your refund using self-service. If a creditor has a judgment against you and wants to garnish your tax refund it must file a Request and Writ for Garnishment with the.

Low Income Taxpayer Clinics. Garnishment of State Tax Refund by Other Creditors. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

If you use Account Services. This threshold applies to all filing statuses and it doesnt double to. 7 Republican candidate Tudor Dixon wouldnt commit to releasing tax returns.

A quick update on irs unemployment tax refunds today. If you received unemployment benefits in 2020 a tax refund may be on its way to you. The IRS has sent 87 million unemployment compensation refunds so far.

However you dont pay tax in Michigan on. The Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs offer free basic tax return preparation to qualified individuals. There are two options to access your account information.

The rule change only. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000.

Year End Tax Information Applicants Unemployment Insurance Minnesota

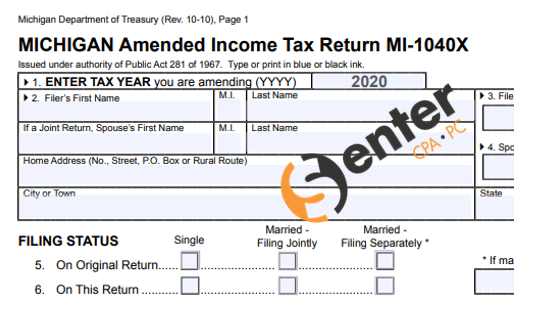

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Irs Issues 510 Million In Refunds To Taxpayers Who Overpaid On Unemployment

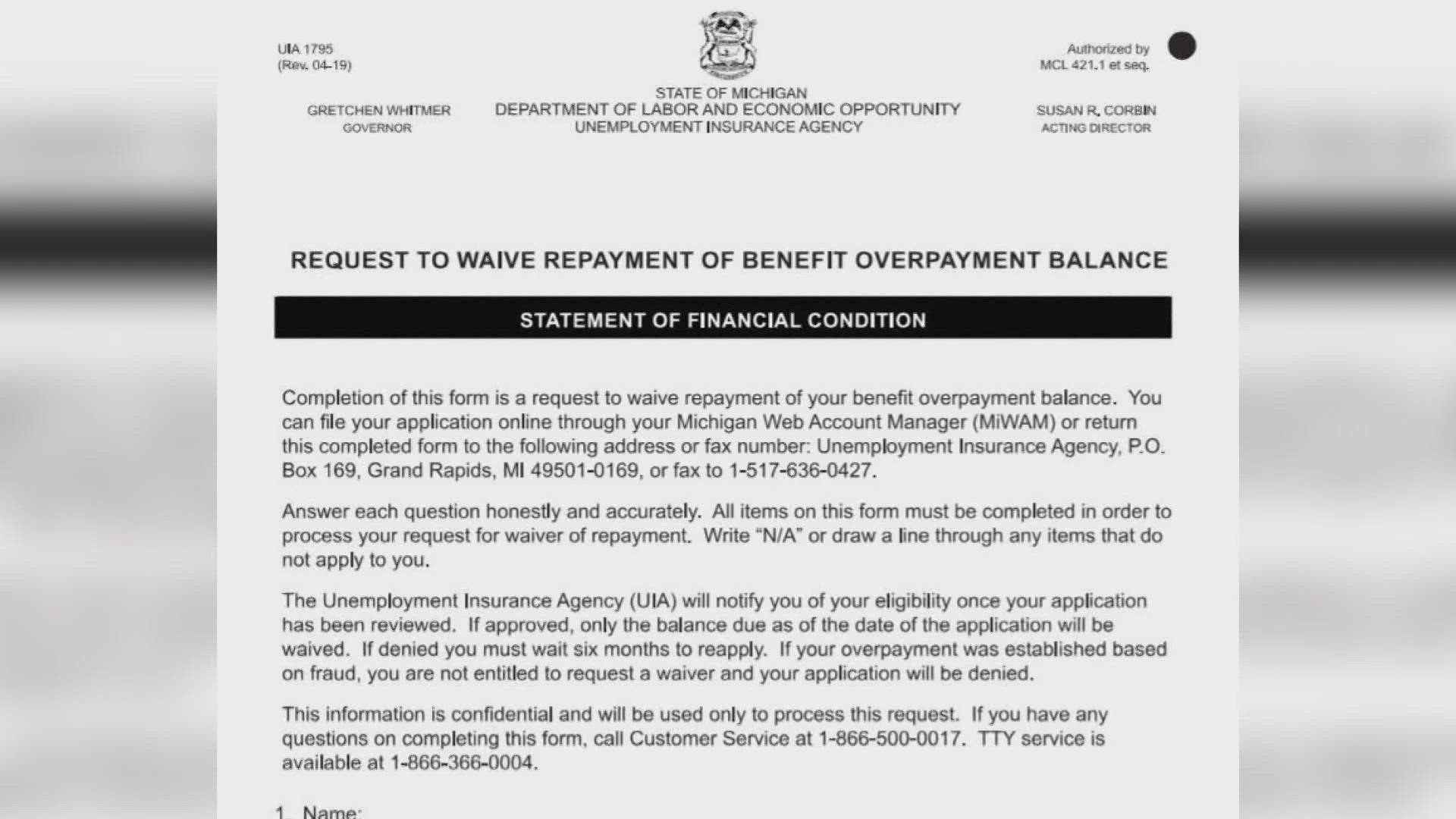

Michigan Some May Need To Amend Their Federal Tax Return If The 10 200 Tax Break Entitles Them To New Tax Credits Like The Eitc R Unemployment

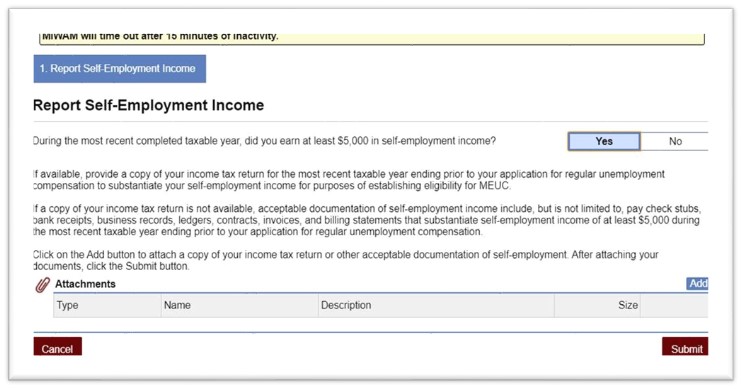

I Filed My 2020 Michigan Individual Income Tax Return Mi 1040 Before The Passage Of The 2020 Unemployment Compensation Exclusion Legislation How Do I Amend My Return

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Unemployment Tax Refund Update What Is Irs Treas 310 Wzzm13 Com

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Where S My Refund Michigan H R Block

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

State Local Tax Impacts Of Covid 19 For Michigan 2021 Forvis

Michigan Unemployment Claim Issues Continue Wzzm13 Com

Income Tax Season 2022 What To Know Before Filing In Michigan Detroit Mi Patch

Rebound Filing Taxes After Getting Unemployment Benefits

Automated Systems Trapping Citizens In Bureaucratic Limbo Time

Mi Sales Tax Software W 2 1099 Reporting Software 940 941 Reporting Software